Australian Football National Risk Protection Program

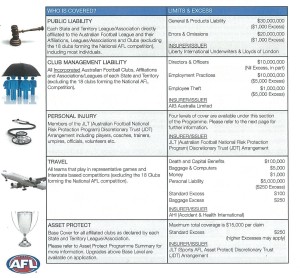

The AFL, in conjunction with the insurance broker JLT sport, has developed a national insurance program, titled Australian Football National Risk Protection Program.

The program includes personal accident, public and products liability, professional indemnity and association liability to protect every player, team, club, league and association in Australia, including the game’s officials, trainers, umpires and volunteers.

For more information on the coverage offered through the program visit the JLT Sport website.

What is Covered?

In general, all football activities are covered. This includes matches, training, functions, meetings and the like (anywhere in Australia). The Programme provides competitively broad protection across the below areas, including coverage for 365 days of the year with an annual renewal date of 1st November.

Personal injury cover is designed to offer some peace of mind to players, officials and volunteers of a club by having protection for certain costs related to an injury sustained whilst involved in a club activity. Clubs have the option of selecting a higher level of cover as well as the flexibility to include Loss of Income. AFL NSW/ACT recommends all players take out Private Health Insurance as an additional cover.

Coverage Limits & Excess

The Personal Injury coverage section of the Programme automatically provides all AFL NSW/ACT affiliated insured clubs Silver level of cover (Excludes AFL Sydney Juniors). Silver Level Cover:

Non-Medicare Medical Benefits – 75% reimbursement, $2,500 max. per claim, $75 excess per claim

Capital Benefit – $150,000 maximum* *Under 18 death is restricted to 20% of the applicable maximum payout of each level

Quad/Para Events – $750,000 maximum

How to make a claim?

-

Obtain a Personal Accident Claim Form via one of the following methods.

-

Download – it here; or

-

Phone – If you wish to have a claim form sent to you by post, phone Echelon on 1800 640 009.

-

Complete all relevant sections of the Claim Form

-

Send your completed form to Echelon within 270 days from the date of injury (earlier is preferable)

-

Echelon will confirm receipt of your claim and/or make contact with you should they require further information

Important Information

Personal Injury coverage through your club is limited by the Health Insurance Act. As such, JLT Sport encourage participants of AFL football to investigate the benefits of private health insurance.

To assist clubs ensure players are aware of the benefits of private health insurance, there is a Private Health Audit available from the Downloads section of this website.

Examples of Non-Medicare Medical items. |

Examples of items covered by Medicare. |

|---|---|

Claimable as per the Policy Wording. |

We can not reimburse you for these costs. |

|

|

*Please note: MRI scans are generally claimable through Medicare, however sometimes the referrer and/or provider is not registered with Medicare. Please check with your treating physician prior to lodging your claim.

In addition, there will be no refund in respect of:

-

Any expenses recoverable by You from any other insurance scheme or plan providing medical or similar coverage or from any other source except for the excess of the amount recoverable from such other policies/plans.

-

Any expense to which the National Health Act (Cth) 1953 or any of the regulations made there under apply.